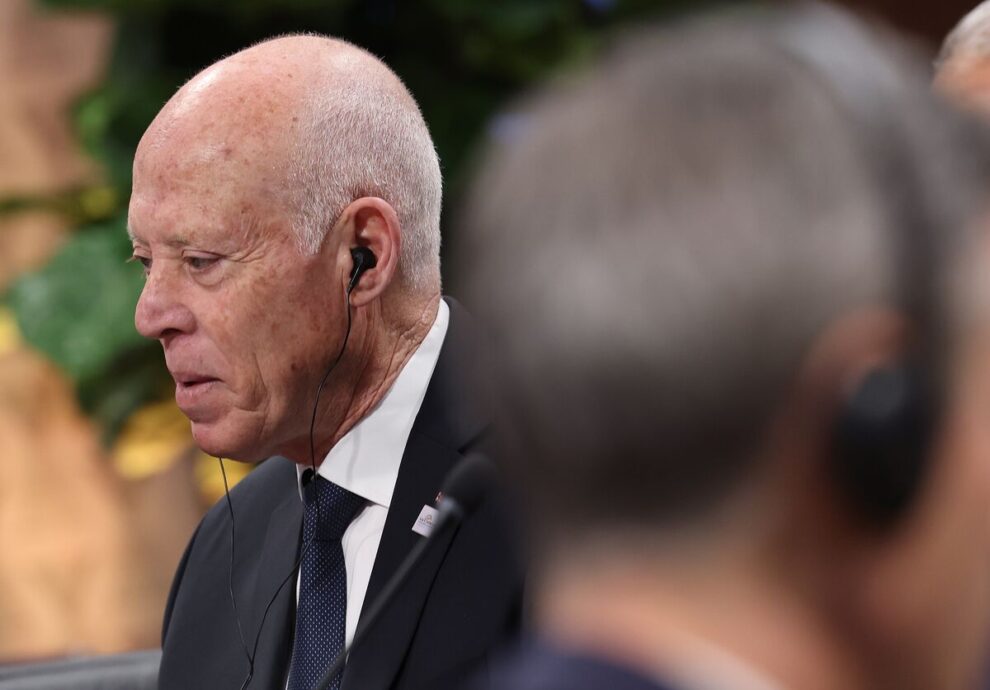

Tunisia plans to curb the independence of its central bank under reforms proposed by the government of President Kais Saied, threatening to further complicate progress toward securing a bailout from the International Monetary Fund.

The changes, expected to be reviewed by an assembly largely beholden to Saied, would add Banque Centrale de Tunisie to a growing list of institutions undermined since the 65-year-old assumed vast powers in 2021, including the judiciary and election commission.

One idea behind the plan is to address a “failure” by the regulator to manage relations with local banks since it gained greater independence in 2016, lawmaker Riadh Jaidane told Shems FM in an interview.

“We aren’t against having a strong central bank that plays a role in the national economy and public finances but there needs to be limits,” said Jaidane, assistant to the speaker, who oversees major reforms. The move is part of “a new phase that breaks with everything that has contributed to disrupting the Tunisian state,” he said.

The central bank didn’t respond to emailed questions about the proposed changes to its statutes and their implications. Spokespeople for the IMF didn’t immediately respond to requests for comment.

‘Homegrown Solutions’

Tunisia needs “national and homegrown” solutions to its problems, Jaidane said, echoing Saied’s argument that foreign influences have caused economic strife since the Arab Spring uprising more than a decade ago.

Saied and Central Bank Governor Marouane El-Abassi were known to have been at odds, especially over the necessity of an IMF bailout. State news agency TAP has admonished the central bank for its support for the rescue plan, which has yet to be reviewed for approval by the multilateral lender’s directors. The 2016 independence move was instrumental to securing a previous $2.9 billion extended arrangement from the IMF.

Tunisia’s sovereign foreign-exchange buffers are about to be tested by a 22.4 billion-yen ($162 million) bond due in August and 500 million euros ($534 million) of debt maturing in October. The government turned to local banks earlier this month to secure a foreign-exchange loan.

Meanwhile, Tunisians are struggling with worsening food shortages that Saied has blamed on unnamed saboteurs within the administration. The bakers union has argued the problem stems from non-payment by the state of subsidies for bread.

Source : BNN Bloomberg